Understanding the Crypto Crash: Causes, Impact, and Future Outlook

Introduction

The crypto crash currency market has become a significant player in the global financial ecosystem, attracting millions of investors seeking high returns. However, the same volatility that drives rapid price increases can also lead to catastrophic crashes. A crypto crash refers to a sharp, sudden decline in the value of digital assets, often resulting in massive losses for investors. Unlike traditional financial markets, the crypto space operates 24/7, making it more vulnerable to rapid shifts in sentiment and value.

Understanding crypto crashes is essential for anyone involved in digital assets. These downturns not only affect individual investors but also impact the broader financial market and future innovation. By analyzing the causes, effects, and future outlook of crypto crashes, investors can make informed decisions, protect their assets, and navigate the volatile landscape more effectively.

What Is a Crypto Crash?

A crypto crash is a significant and often sudden decline in the value of cryptocurrencies, typically marked by double-digit percentage losses over a short period. This phenomenon is not merely a market correction—which involves gradual price adjustments—but a steep and rapid drop that reflects broader systemic issues or external shocks. For instance, the cryptocurrency market witnessed dramatic crashes in 2018 and 2022, where billions of dollars in market value were wiped out in days.

Unlike corrections that serve as healthy market recalibrations, crashes often trigger panic selling and prolonged bearish conditions. Crypto crashes can also result from unique vulnerabilities in the digital asset space, such as regulatory crackdowns, security breaches, and market manipulation. The decentralized and speculative nature of cryptocurrencies exacerbates these crashes, leading to greater unpredictability compared to traditional financial systems.

Causes of a Crypto Crash

Market Speculation and Volatility

One of the primary drivers of crypto crashes is market speculation combined with extreme volatility. Cryptocurrencies, unlike fiat currencies, are not backed by physical assets or regulatory oversight, making their value largely speculative. When investor enthusiasm is high, prices surge rapidly. However, this speculative bubble can burst just as quickly, leading to a crash.

Moreover, the cryptocurrency market is susceptible to rapid mood swings. Positive news can drive prices up, while negative sentiment or rumors can trigger widespread panic selling. Leveraged trading, where investors borrow funds to amplify their positions, further increases volatility. When prices drop suddenly, leveraged positions get liquidated, accelerating the downward spiral.

Regulatory Actions and Legal Uncertainty

Government regulations play a significant role in shaping the cryptocurrency market. Sudden regulatory crackdowns or the introduction of restrictive laws can trigger massive sell-offs. For instance, when China banned cryptocurrency trading and mining, the market experienced severe declines. Similarly, actions by the U.S. Securities and Exchange Commission (SEC) against major crypto firms often lead to uncertainty and falling prices.

Legal ambiguity surrounding cryptocurrencies also fuels market instability. Without clear guidelines, investors face increased risks, and projects may struggle to comply with different regulatory frameworks. This unpredictability can dampen investor confidence, leading to abrupt market corrections or crashes.

Macroeconomic Factors

Global economic conditions, such as rising interest rates and inflation, also contribute to crypto crashes. During periods of economic uncertainty, investors often move away from high-risk assets like cryptocurrencies toward safer investments, such as government bonds or gold. When the Federal Reserve raises interest rates, the cost of borrowing increases, reducing liquidity in speculative markets.

Cryptocurrencies are also increasingly correlated with traditional financial markets. Economic downturns, global recessions, or geopolitical tensions can spill over into the crypto space, causing widespread panic and asset sell-offs.

Security Breaches and Scandals

Security breaches and major scandals significantly undermine market trust. High-profile hacks, such as the Mt. Gox incident, where millions of dollars were stolen, have had devastating impacts on investor confidence. Exchange collapses, like the FTX meltdown, not only wiped out user funds but also led to a prolonged market downturn.

When users lose faith in the security of their investments, they often rush to withdraw or sell their holdings, further exacerbating price declines. Each new security breach reinforces skepticism about the crypto market’s long-term viability.

Investor Sentiment and Panic Selling

The psychological factor of investor sentiment cannot be overlooked. When prices start to fall, fear spreads rapidly across the market, leading to panic selling. Social media platforms amplify these fears by spreading misinformation and hype, creating a feedback loop of declining prices.

Herd mentality plays a significant role during a crash. As more investors sell off their assets to cut losses, prices drop further, prompting even more panic-driven selling. This collective behavior accelerates the crash and prolongs market recovery.

Impact of a Crypto Crash

On Individual Investors

A crypto crash can be financially devastating for individual investors. Many who bought during price peaks face substantial losses, especially if they lack a diversified portfolio. Emotional stress and mental health challenges often accompany these financial setbacks.

For long-term investors, crashes present both risks and opportunities. While short-term losses are unavoidable, some investors use downturns to accumulate assets at lower prices, anticipating future recoveries. Effective risk management, such as setting stop-loss orders and avoiding excessive leverage, is crucial for protecting personal investments.

On the Crypto Industry

Crashes also affect the broader crypto industry. Startups reliant on crypto funding may struggle to survive prolonged bear markets. Innovation slows as developers and investors retreat from the space. Moreover, trust in cryptocurrencies as a reliable asset class erodes with each successive crash.

However, these downturns also drive regulatory improvements and encourage the adoption of better security practices. Projects that survive crashes often emerge stronger, fostering future growth and maturation of the industry.

On the Global Economy

While crypto crashes have not yet triggered global financial crises, their impact on institutional investors is growing. Companies holding significant crypto assets face balance sheet volatility. Furthermore, the proliferation of decentralized finance (DeFi) poses systemic risks if large-scale liquidations occur.

As cryptocurrencies become more integrated into traditional financial systems, future crashes could have broader macroeconomic implications. Governments and financial institutions are increasingly monitoring these developments to mitigate systemic risks.

Conclusion

Crypto crashes are an inherent part of the volatile digital asset landscape. Understanding the causes—including market speculation, regulatory actions, and macroeconomic factors—is essential for navigating these downturns. While crashes can be financially and emotionally challenging, they also present opportunities for informed, long-term investors.

By learning from past crashes, adopting robust risk management practices, and staying informed about regulatory changes, investors can better position themselves in the unpredictable world of cryptocurrency. As the industry continues to evolve, resilience and caution will be key to weathering future storms.

FAQs About the Crypto Crash

- What is the main cause of a crypto crash?

- Crypto crashes are primarily caused by market speculation, regulatory actions, security breaches, and macroeconomic factors.

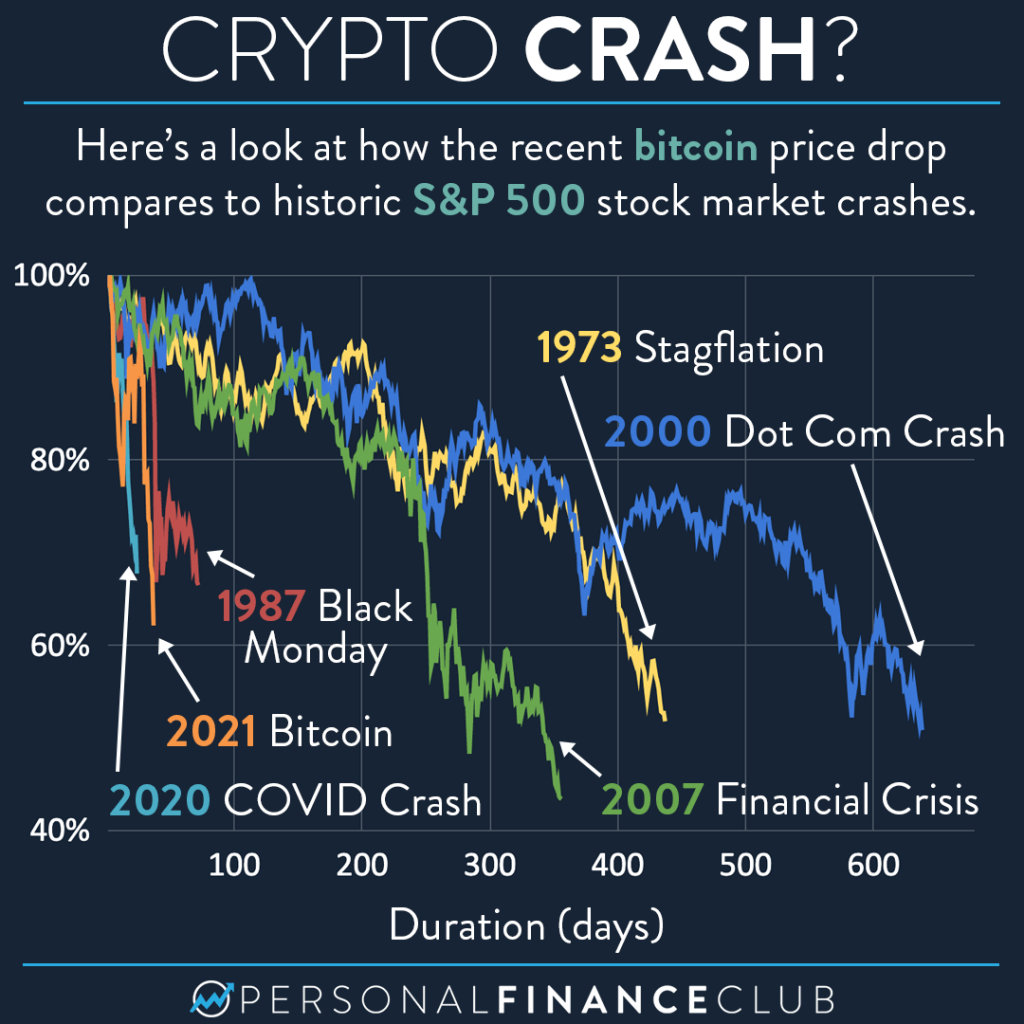

- How long does a crypto crash typically last?

- The duration varies, ranging from a few weeks to several years, depending on the cause and market conditions.

- Can cryptocurrencies recover after a major crash?

- Yes, many cryptocurrencies have recovered from previous crashes, though recovery is never guaranteed.

- What should I do if my crypto investments lose value?

- Consider diversifying your portfolio, setting stop-loss orders, and researching long-term investment strategies.

- Is it safe to invest in crypto during a market crash?

- Investing during a crash can offer opportunities but carries significant risks. Conduct thorough research before investing.